More MannKind Musings 3/11/15

***The following is excerpted from the March issue (3/6/15) of Nate’s Notes that was published for subscribers last weekend***

I skate to where the puck is going to be, not where it has been.

– Wayne Gretzky

“It Doesn’t Need To Be Rocket Science…”

Given the wild ride that MannKind’s stock has been on for the past couple of weeks (actually quarters… or even years, really, depending how long you’ve been following the story!), it should come as no surprise that it is far and away the stock that I have been asked about most often lately, and, as promised in the email sent out to subscribers a few days ago, I want to spend some time discussing certain aspects of the story again in order to help you figure out how involved (or uninvolved) with the story you actually want to be at this stage of the game based on your own investment objectives and tolerance for risk.

In fact, given the wide range of emotions that have been expressed to me over the past week in response to the price movement in the stock, “risk tolerance” is probably a great place to start the conversation… and what better way to start it than to simply repeat a variation of one of our favorite mantras in the newsletter, namely “do not own more of the stock than you can comfortably sleep with at night.” There are never any guarantees in the stock market (other than “stock prices will fluctuate,” of course), and while I remain optimistic that this is a stock we will likely make a lot of money on over the next several years, I cannot promise you it won’t see $4 per share before it sees $8 again, for example.

That being said, I want to remind you of the main reasons we own the stock, and then I will try to touch on as many of the recent “news events” as space allows.

So, why do we own the stock? In a nutshell, diabetes is a huge and growing market, and prandial (or “meal time”) insulin is a multi-billion dollar subset of that market. And, while scientists have made great strides over the decades figuring out ways to deliver meal time insulin to diabetics in an increasingly efficient manner, the fact of the matter is that they have essentially “hit the wall” in terms of being able to improve upon existing products.

However, thanks to the unique composition and delivery method of MannKind’s Afrezza, it is my contention that this segment of the insulin market is about to be turned on its head… and though it may take longer than the optimists are hoping for the paradigm shift to hit critical mass, I believe that once that tipping point is reached, it won’t be more than a year or two longer before doctors and patients will be looking back on “the way they used to do things before Afrezza came along” (and, yes – the implication there is that Afrezza will be the dominant player in the multi-billion dollar meal time insulin market).

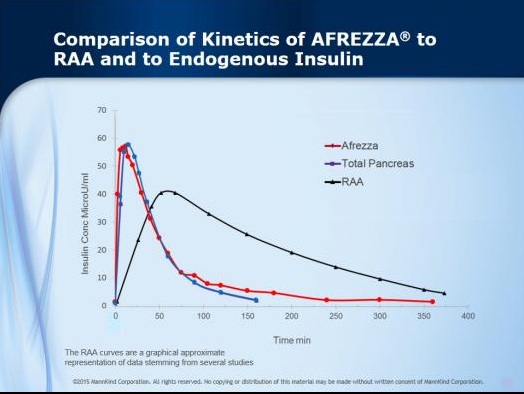

Not sure if you believe me? Pretend you had never heard of MannKind nor Afrezza but were presented with the chart below that graphically shows how a “new insulin product” (in red) compares with “existing insulin products” (black) in terms of the way they enter and exit the body as part of a patient’s effort to control blood sugar levels around meals. Though there are folks out there who are still arguing that a “slow uptake and slow exit” from the body is “just fine,” common sense certainly suggests that the product that more closely (much more closely, in fact) matches the way insulin is produced and used in the bodies of non-diabetics (blue) is probably going to also come much closer to allowing diabetics to lead “normal” lives rather than spending a sizable chunk of their time managing their diabetes.

Of course, what makes the story that much more compelling is the fact that not only would the new product be considered superior even if it was also an injectable product, it happens to have the added benefits of not only eliminating needles from the equation in terms of delivering the insulin, but of also doing so in a manner that is extremely easy and convenient relative to “the old way.”

And this brings us to the first “point of contention” many of you have asked about this week, namely that a big deal is once again being made of the fact that in the most recent clinical trials that were done using Afrezza, the drug didn’t appear to show much of a benefit versus existing therapies.

Though I will be the first to admit that, based on those trials (the results of which were announced in 2013), no clear advantage was seen, I will also point out that based on how the studies were designed (using what I believe will eventually be considered “old school” ways of measuring success), it should come as no surprise that no clear benefit was seen – and if those trial results are what one wants to base their assessment of Afrezza on, I would respectfully suggest that they are skating to where the puck has been rather than where it is going in terms of how patients are starting to manage their diabetes.

Rather than measuring “success” in controlling blood sugar levels via a process of keeping data over a period of several months and shooting to have average readings that are below certain target levels (as has been done for decades), diabetics today have the ability to monitor themselves on a real-time basis (or very close to it, give or take a few minutes)… and, though the studies have not been done yet, once they are done, I believe it is very likely they will show that Afrezza is a far more useful tool for managing blood sugar levels than anything else on the market today.

To be sure, until the studies are done, neither MannKind nor Sanofi can actually make the claim “on the label,” but I think it is important to keep in mind that there is nothing that prohibits patients from sharing their personal experiences with a product (something that is already happening via social media), and if doctors are noticing trends in their patient populations, they are always free to act on those observations regardless of what labels actually say… and thus, it is important to keep in mind that we do not necessarily have to have to wait for these studies to be completed before we might start to see the results “ahead of time” in the real world patient population.

Which brings us to another point I have been asked to address, namely, “what sorts of prescription numbers should we be looking for to know if Afrezza is going to be a success or not?”

To be honest, I do not have a number in mind… but what I do want to emphasize to you is that a) it will take a while for patients and doctors alike to get up to speed with Afrezza (see below), and b) with the exception of some extreme readings on the weekly new prescription front (i.e. a flatline at 150 per week or a sudden jump to 1,000+, for example), I think the very earliest we could start to see meaningful trends will be somewhere in months 4-6 or so.

Yes, I know a lot of the pessimists have been mocking the “low” numbers of prescriptions that have been generated so far, but I want to remind you of a number of variables that are in play at this stage of the game.

First off, even if someone wanted an appointment right now to possibly switch to Afrezza, for most doctor’s offices these days, there is probably a 2-4 week waiting period for any sort of non-urgent appointment (a situation made that much more pronounced by the fact that most diabetics are already on a “diabetes check-in schedule” with their doctors anyway, so they would probably be told to just wait until their next one rolls around “a few months from now”).

Add to this the observation that most diabetics usually have at least a 2-4 week supply of insulin on hand at any given time to begin with, along with the fact that Sanofi has also been giving out free samples of the product that ought to cover most diabetics for 10-14 days, and it should come as no surprise that Afrezza has not “taken over the market” just yet.

Along with these practical matters regarding appointments and insulin supplies during the first 6-8 weeks that Afrezza is on the market, I think it is also worth noting that while there are some family practice docs who do like to be on the cutting edge, many of them will probably take a more conservative approach and “let the endocrinologists spend some time working with Afrezza” before they’re willing to start prescribing it… and thus, I want to repeat what I said above, namely that we shouldn’t put too much weight on the prescription numbers until we get into the June-August time-frame.

That being said, another “issue” that I have been asked to comment on is the recent downgrade of the stock by Jay Olson, an analyst from Goldman Sachs, “due to lower than expected sales of Afrezza.” While it may be true that Afrezza sales are coming in slower than he and his team expected, I think it is important to keep in mind that the model against which they are measuring sales is a model that they came up with on their own (and, by their own admission, it did miss things by a mile in a number of different sectors across the diabetes market, so you can’t really fault them for wanting to make revisions!); however, in typical Wall Street fashion, once their model proved to be far from accurate, rather than downgrading themselves for doing such a crummy job in the first place, they chose instead to downgrade the companies (while simultaneously trying to get us to believe that their new models are somehow going to be much more accurate than their old ones – such is the Wall Street way, eh?).

In addition, anyone who has ever tried to build a sales and earnings model knows that four weeks is nowhere near enough time to know with any degree of confidence whether the model is a good one or not… so Jay Olson’s decision to abandon his model so early in the process certainly makes one wonder what else is going through his head at the moment. On the “tame” end of the conspiracy theory spectrum is the idea that he is simply downgrading it today so that if/when he upgrades it again in response to good Afrezza numbers and/or a significant announcement on the Technosphere front, he may have a chance to do so from an even lower price point (he hopes), and on the more dramatic end of the spectrum, it has been pointed out by a number of folks that he and Sanofi’s new CEO were at Pfizer at the same time, and there may be some bad blood between the two of them (purely rumors, mind you).

Either way, I found the reasons for the downgrade to be laughable, especially since Afrezza is currently off to a start that is more than ten times better than Exubera’s was (the only other launch Jay Olson and his team could realistically be looking at as a benchmark for comparison when putting their models together). And, as a parting thought on this topic, I believe it is worth noting that even though there is supposed to be a firewall between the buy side and the sell side at firms like Goldman, it will be very interesting to see whether or not the firm has, in fact, continued to aggressively add to its position in MannKind during the quarter (after doing so last quarter) despite this dramatic downgrade by its analyst on the sell side.

Along with the above issues, there are a few others I have been asked to address, but since I am starting to run out of space, I will do so in a bullet-point format in hopes that my comments will give you “enough” to go on when making your investment decisions:

• virtually all of the insider sales we have seen over the past couple of years have been pre-planned sales, and they have all been executed by the non-billionaire members of management for whom such diversification absolutely makes sense; Al Mann himself has not parted with a single share (though he just as easily could have entered into a pre-planned sale program too if he was anxious to move capital out of the story), and from this, I think it is safe to assume that he is not likely to sell the company for anything less than $12 per share (assuming an offer appeared);

• speaking of buying and selling by large players, I believe it is also worth noting that institutional ownership has been increasing, not decreasing, over the past several months, and, perhaps more importantly, while it is true that there are quite a few more shares outstanding today than there were a year ago (the “awful dilution” certain detractors of the stock like to point to), those shares came into existence because large holders of debt decided they would rather have an equity stake in the company… and the only reason I’ve ever seen large debt holders convert a sure thing into a risky thing is if they found the payoff potential to be even more attractive;

• there has been a lot of fuss made about the fact that Sanofi “isn’t doing much” to market the product yet… and, while it is true that they seem to be going out of their way to not set expectations too high, before you become too discouraged by the situation, I think it is worth keeping in mind that a) they have already plunked $200 million on the table as part of the relationship with MannKind (with another $700 million or so still on tap in the form of milestone payments), b) they desperately need a catalyst to get their diabetes program back on track, and having Afrezza on the front end of a one-two punch for meal time insulin paired with their new long-acting insulin product (Toujeo) ought to go a long ways towards this goal; c) to be sure, logo placements don’t sell product, but I found it especially interesting that in its slide for “new product launches” as part of a recent presentation, Toujeo and Afrezza were placed side-by-side in the center of the top row (of two), and I don’t think this “front and center” placement was on accident; and, finally, d) though perhaps not as loudly as some bulls would like, Sanofi IS talking about the product… and they claim to be getting plenty of positive feedback from their sales reps out in the field regarding doctor and patient interest;

• finally, it is important to keep in mind that now that Afrezza has been handed off to Sanofi, MannKind is turning its attention back towards Technosphere, the platform that allows it to take existing compounds and deliver them to the body via inhalation rather than orally or by injection. The company claims that it has narrowed down the list of possible candidates for this program to those that it finds most promising in terms of market size and cost/time to develop, and though they are keeping the targets under wrap for the time being, it would not surprise me at all if we start to get more visibility on this front sometime later this year.

Yes, there is plenty more I can talk about regarding the story, but I hope that the above helps give you some confidence that even if it takes awhile for things to play out, there are a lot of reasons to think we are going to make a lot of money in this stock as time goes by… but it will require patience, and there will undoubtedly be plenty more volatility along the way. That being said, I want to remind you that I have quite a bit of my own money invested alongside yours (and Al Mann’s), and so I, too, feel your pain when the stock drops; however, as mentioned before, I really do believe that this is probably one of the most inefficient markets I have ever seen develop for a stock in the sector – and that means opportunity (just don’t own more than you can comfortably sleep with at night!)

I could talk forever when it comes to discussing various angles of the MannKind story, but I suppose the best thing I can do with this space this time around is to simply remind you that while there is definitely a lot of science involved when it comes to diabetics keeping their blood sugars in line, at the end of the day, it boils down to an art for each individual patient. With patients becoming more and more able to track their sugars in close to real-time, they are going to start demanding an insulin that is able to keep up with them – and Afrezza is the only insulin currently on the market that has any hope of meeting that demand. Buy only as much as you can sleep with at night! MNKD is a strong buy under $6 and a buy under $9.